The Section 179 Tax Deduction is Still Available - Save on Your Equipment Purchases Before January 1

Two years back, we talked about the Section 179 tax deduction. Last year it was extended. I’m happy to say that it’s still available, and you can still use it to save on industrial equipment purchases.

Forklifts, of course, but also pallet jacks, rack & shelving, and so on. Best of all, the equipment can be new or used. Letting you save even more.

If you’re planning purchases before the end of 2014, make sure you take advantage of Section 179.

What is Section 179?

IRS Tax Code Section 179 is a special deduction on buying new & used equipment.

Normally, a business would depreciate its newly-purchased forklift over its expected life (average 5-7 years). That means the tax benefits of purchasing a new unit are spread out over those tax years.

The 2008 Stimulus Act changed that by introducing Section 179. It allows a business to deduct the full price of purchased equipment in the year it was purchased and put into service.

You can deduct any equipment purchased up to $25,000, if the total amount of equipment you buy doesn’t exceed $200,000. If it does, the deduction is phased out gradually until you hit $225,000. After which point Section 179 is not available.

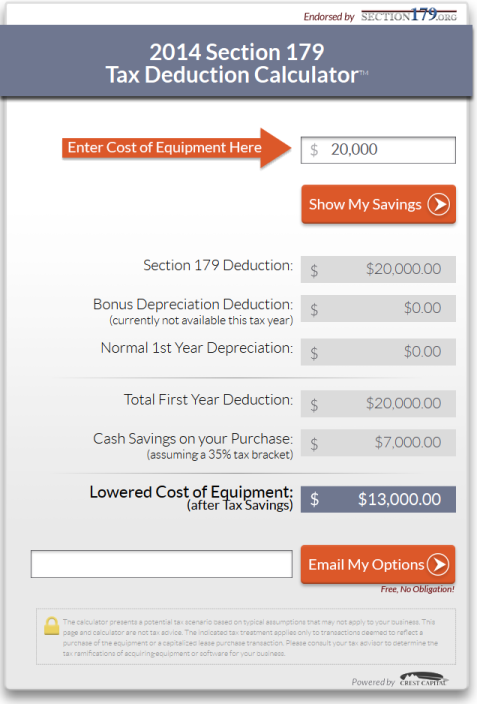

Here’s an example of how Section 179 breaks down, if you spent $20,000 on equipment.

Essentially, Section 179 can put 5-7 years’ worth of tax benefits into your pocket in one tax year.

Crest Capital has a live calculator for determining how much you’d save with Section 179. Visit the CrestCapital.com Tax Deduction Calculator page to try it out.

Can You Use Section 179 When Buying Material Handling Equipment?

Yes. In fact, most of our inventory falls under Section 179 Qualifying Purchases, as Machinery and Business Equipment. The Section179.org website lists property that qualifies for the deduction.

Your company can also lease equipment and still take the Section 179 deduction. (Check our Deal of the Month for a great lease option – which you can then deduct!)

How Do I Take Advantage of Section 179?

- Buy/lease equipment you need for the coming year (such as forklifts, new or used) before December 31.

- Total your equipment purchases. Remember the $200,000 threshold.

- Consult your CPA or tax advisor on writing off your tax savings as per Section 179.

If you have more questions about using Section 179 on your material handling purchases, please talk to your tax professional. Then come by Cromer Material Handling and let us help you find the right equipment for 2015.

Until next month!

Marshall Cromer, The Forklift Boss

Cromer Material Handling