Section 179 Tax Benefit Boosted for 2018

Now that we've entered the 4th quarter, it's time for a reminder about Section 179. This year it gets even better, thanks to the "Tax Cuts and Jobs Act" passed in late 2017.

The Act significantly boosted the deduction limits for both Section 179 and its Bonus Depreciation. Which makes them more useful than ever before.

Tax Benefit Details

The Section 179 tax deduction allows businesses "to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year." Buy (or lease) qualifying equipment and you get to deduct the FULL purchase price.

Here's a quick rundown on Section 179's 2018 status:

- Section 179 applies to new and used material handling equipment. That includes forklifts, pallet jacks, attachments, and industrial vehicles.

- The current deduction limit for Section 179 has risen to $1 million USD.

- The limit on equipment purchases went up to $2.5 million USD.

- The Bonus Depreciation is at 100%, and good through 2022.

- Section 179 tax benefits only apply if you've taken delivery of your equipment before January 1.

Keep in mind that the China tariffs are in effect. Prices on some forklifts may have gone up. Luckily Cromer carries several brands not subject to tariff, such as Doosan and Jungheinrich. We'll find you the right forklift at the right price, no matter what.

You can find out more details at the redesigned Section179.org. The new website has a tax calculator for determining your exact tax benefit for 2018.

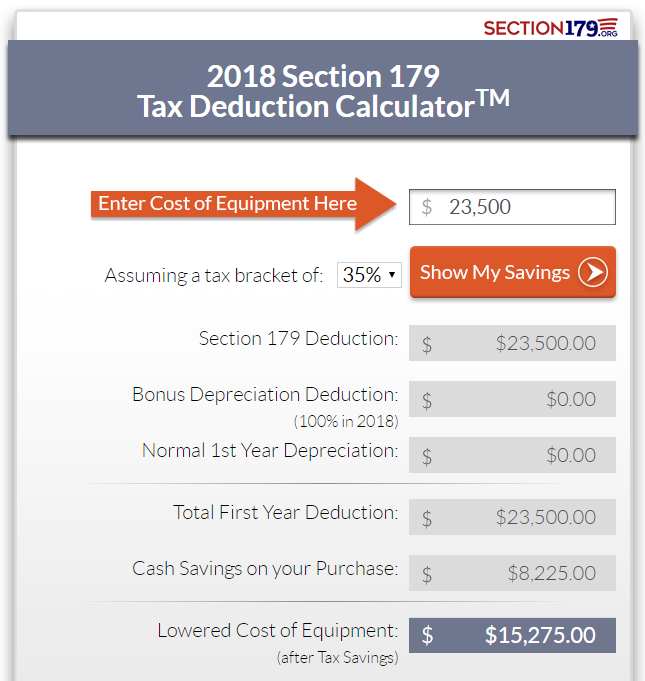

I put in the costs for a new Doosan forklift we have for sale as a demonstration.

Even on one forklift, you still save over $8,000 on true cost. Now think back over all the equipment purchases your company made in 2018. Add in any computer or software purchases too; those qualify. Thanks to Section 179, you can deduct 100% of ALL of them (up to $2.5 million).

That's some serious tax savings.

Buy Before New Year's and Save More Than Ever

If want to save even more on taxes for new/used material handling equipment, order before the end of the year and take advantage of Section 179. You must put equipment into business use by December 31, so don't wait!

Contact your local Cromer facility before the end of December to take advantage of Section 179. Not only will we help you work out the Section 179 deductions, we will make sure you have the equipment in place & qualified.

Until next month…Happy Halloween!

Marshall Cromer, The Forklift Boss

Cromer Material Handling

Deal of the Month

2018 DOOSAN G25N-7LP LPG FORKLIFT – $23,500

The Doosan we used for the Section 179 example? We're making it our Deal of the Month too.

The Doosan we used for the Section 179 example? We're making it our Deal of the Month too.

This is a 2018 Doosan G25N-7LP. It's an LPG forklift with a 5,000# capacity, pneumatic tire, and a three-stage 80/169 mast.

This forklift is lowered, which makes it useful on parking lots.

Brand new—it only has 1 hour on it. We put that hour on it driving around the shop for testing!

It's on sale for only $23,500.

We currently have this forklift at our Oakland location. To take advantage of this deal, call Cromer at 800.974.5438 and ask for the October Deal of the Month.