Reminder: Section 179 Tax Deduction Still Available (at a Reduced Amount)

We're all thinking of the holidays these days. Shopping, seeing relatives, lots of cooking...

Before that, let the Forklift Boss give you a quick business reminder. There’s one month left in the year. One month left to use the Section 179 tax deduction for buying/leasing equipment.

Section 179 changed for 2015. There are important differences you should know. That’s what we’re covering right here.

What It Is

First, a quick refresher. IRS Tax Code Section 179 is a special deduction on buying new & used business equipment. It allows a business to deduct the full price of purchased (or leased) equipment in the year it was purchased and put into service.

We described it last year as, "putting 5-7 years’ worth of tax benefits into your pocket in one tax year."

You’ll find the ins and outs on 179 at the Section 179 FAQs page. What’s important now is what’s different for this year.

What's Different This Year

Congress lowered the 2015 deduction limit back down to $25,000. There’s also no bonus depreciation this year (it used to be a 50% one-time depreciation).

However, this still brings a lot of tax savings. Let’s walk through an example.

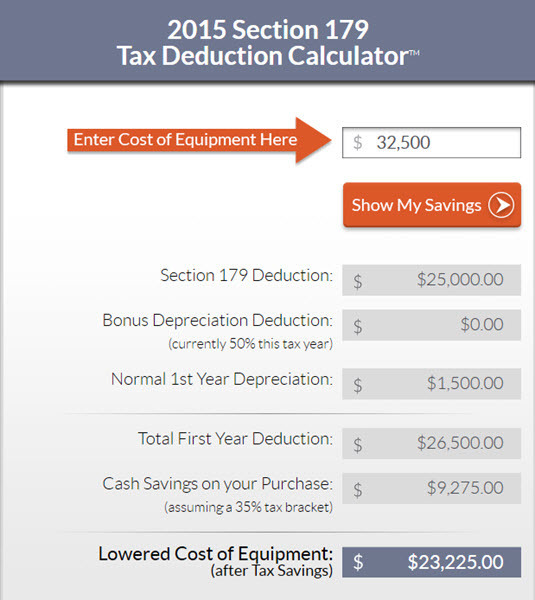

Section179.org includes a Deduction Calculator to show you how much you can save. There’s an electric forklift on ForkliftBoss.com right now for $32,500. We plug that number into the calculator, and we get:

The total equipment cost goes from $32,500 to $23,225. After using the 179 deduction, you save almost $10,000!

What This Means for Cromer Customers

Section 179 still benefits you. You’ll see a tax savings on almost all Cromer products. I had a customer come in just last week & pick up a stack of warehouse rack. He told me he did it now instead of in January because of 179. It helped him justify the up-front cost.

If you still have purchases in mind for 2015, now’s the time to get them in. And to use the Section 179 tax deduction.

See you next month!

Marshall Cromer, The Forklift Boss

Cromer Material Handling

ForkliftBoss.com Deal of the Month

BUY A FORKLIFT, GET A FREE PALLET JACK

For the November deal of the month, we’d like to continue last month’s giveaway. But this time we’re upping the stakes.

For the November deal of the month, we’d like to continue last month’s giveaway. But this time we’re upping the stakes.

Now, if you buy a new OR used forklift from Cromer, you get a manual pallet jack. Free.

We have Clark and Doosan manual pallet jacks in stock and ready to roll. You’re looking at carrying capacities of up to 5,500lb—plenty to move full pallets where they need to go in the warehouse.

This Deal of the Month applies for ALL new & used forklifts in the Cromer inventory—including the forklifts on ForkliftBoss.com.

But it only lasts until Christmas! So order your forklifts before it’s too late.

Click the link to visit ForkliftBoss.com or call Cromer at 800-974-5438. Make sure to mention the Pallet Jack Deal!